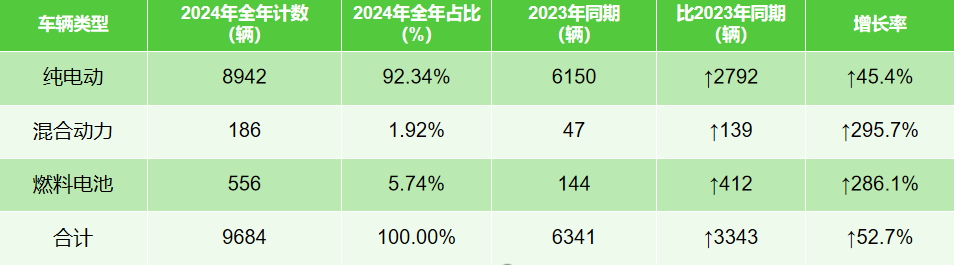

Yiwei Motors has collected and analyzed sales data for the new energy sanitation vehicle market in 2024. Compared to the same period in 2023, sales of new energy sanitation vehicles increased by 3,343 units, representing a growth rate of 52.7%. Among these, sales of pure electric sanitation vehicles rose by 2,792 units, a 45.4% increase, while fuel cell sanitation vehicle sales grew by 412 units, an impressive surge of 286.1%. Pure electric models accounted for 92.34% of total annual sales.

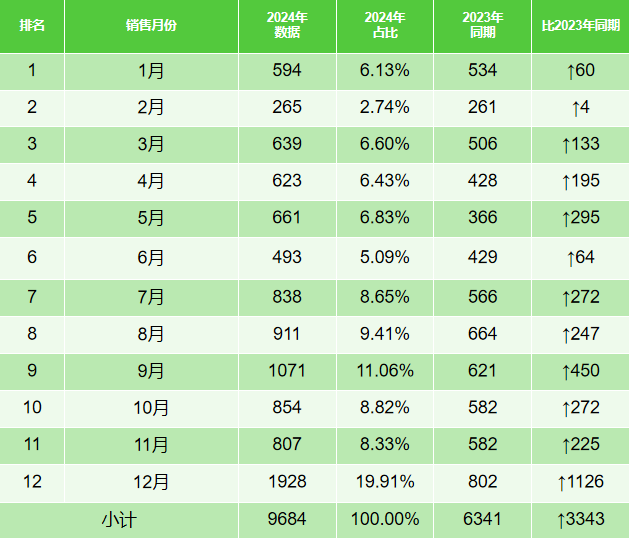

Throughout 2024, sales of new energy sanitation vehicles showed a stronger performance in the second half of the year, with the fourth quarter standing out as the best period, selling 3,589 units and contributing 37% of total annual sales. December was the peak month, with 1,928 units sold, accounting for 19.91% of the total.

Using Deepseek (a leading domestic AI model hailed as China’s “AI pride” and making waves in the global AI community), Yiwei Motors analyzed the 2025 market trends for new energy sanitation vehicles in China based on 2024 sales data. The analysis reveals the following key insights:

1. Incremental Market Growth

Under the “Dual Carbon” policy framework, the expansion of pilot cities for the comprehensive electrification of public sector vehicles (following the success of the first batch launched in 2023) and the stringent requirements of the “Air Quality Continuous Improvement Action Plan” have significantly boosted local government procurement. In 2024, the top five provinces/municipalities (Hebei, Guangdong, Sichuan, Beijing, and Hunan) accounted for nearly 60% of total sales, reflecting the strong demonstration effect in economically robust regions. In 2025, second- and third-tier cities, as well as northern regions facing greater environmental governance pressures, are expected to accelerate their adoption, driving market penetration to exceed 15%.

2. Opportunities in the Hydrogen Fuel Cell Sanitation Vehicle Market

While pure electric models, supported by a mature industrial chain (92.34% market share), remain the mainstream, the 286.1% growth rate of fuel cell models indicates emerging opportunities. In 2024, the hydrogen energy sector saw a surge in supportive policies (with fuel cell vehicle demonstration city clusters expanding to five) and a decline in system costs (average fuel cell system prices dropped). Given the fixed routes and centralized refueling characteristics of municipal sanitation operations, this sector is poised to become the best testing ground for hydrogen energy commercialization. By 2025, fuel cell models are expected to capture over 8% of the market.

3. Market Expansion

The top five provinces accounted for nearly 60% of sales in 2024, highlighting the significant demonstration effect in core regions. Building on the success of these regions and continued policy support, the market in 2025 will evolve in two ways: first, third- and fourth-tier cities will activate demand through incentive-based policies, and second, regions like Sichuan-Chongqing and Northwest China will leverage their green energy advantages to develop hydrogen-powered sanitation systems. The concentration of sales in the top five provinces is expected to drop to around 50%, while demand in leading cities will shift toward high-end models (e.g., intelligent, information-enabled, and large-tonnage vehicles), creating a diversified market landscape.

4. Structural Optimization

The fourth quarter’s 37% sales share reflects the year-end集中交付 (concentrated delivery) pattern, indicating the cyclical nature of government procurement. As operational cost sensitivity increases, the market in 2025 will place greater emphasis on lifecycle economics and comprehensive scenario solutions. Leading companies will begin bundling value-added services such as charging operations, battery banking, and sanitation vehicle leasing. However, fluctuations in power battery prices (lithium carbonate prices have dropped 70% from their peak) may trigger a restructuring of the industrial chain, giving vertically integrated companies a competitive edge in risk resilience.

Conclusion

Whether through a direct comparison of 2024 and 2023 sales data or the use of Deepseek’s cutting-edge AI analysis, it is clear that the new energy sanitation vehicle market will continue to grow despite temporary challenges posed by fiscal and infrastructure gaps. As the market shifts from policy-driven to market-driven growth, the main themes will be “accelerated technological iteration, innovative business models, and regional market penetration.”

Post time: Feb-14-2025