The Ministry of Finance, the State Taxation Administration, and the Ministry of Industry and Information Technology have issued the “Announcement of the Ministry of Finance, the State Taxation Administration, and the Ministry of Industry and Information Technology on the Policy Regarding Vehicle Purchase Tax Exemption for Non-Transport Special Operation Vehicles with Fixed Installations” (No. 35 of 2020) and the “Announcement of the State Taxation Administration and the Ministry of Industry and Information Technology on the Management of Vehicle Purchase Tax Exemption for Non-Transport Special Operation Vehicles with Fixed Installations” (No. 20 of 2020), further optimizing the management mechanism of preferential policies for special purpose vehicle purchase tax.

Convenience and preferential policies for customers purchasing new energy sanitation vehicles:

01 Simpler Processing

The tax exemption process has been changed from being audited by the tax authorities to being entrusted to professional institutions for review. Instead of relying on the “Tax Exemption Catalog” for comparison, the tax benefits are now automatically enjoyed based on the “Catalog of Non-Transport Special Operation Vehicles with Fixed Installations Exempted from Vehicle Purchase Tax” (referred to as the “Catalog” hereinafter).

The “Catalog” includes the “List of Vehicle Names for Inclusion in the Catalog of Non-Transport Special Operation Vehicles Exempted from Vehicle Purchase Tax” (referred to as the “List” hereinafter). For specialized vehicles listed in the “List,” applicants no longer need to apply for inclusion in the “Catalog” separately but can directly indicate the tax exemption status when uploading vehicle electronic information.

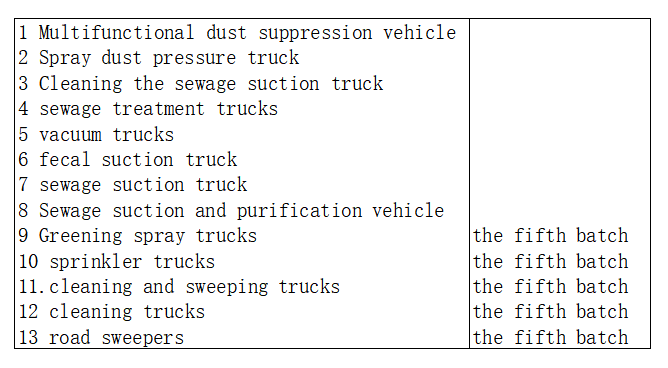

Note: The vehicle names in the “List” can be expanded to include corresponding names for new energy vehicles, such as “pure electric multifunctional dust suppression vehicle.” The first column (壹) in the table below represents the new energy vehicle models involved in automobile production.

Non-transport special purpose vehicles with fixed installations that are not listed in the “List,” such as cleaning and sprinkler trucks, need to go through the Special Operation Vehicle Exemption from Purchase Tax declaration window in the system of the Ministry of Industry and Information Technology to submit the purchase tax report.

02 Reducing the cost of car purchases

The “List” includes various specialized vehicles manufactured by the automobile industry, such as multifunctional dust suppression vehicles, spray dust suppression vehicles, cleaning and suction vehicles, sewage treatment vehicles, vacuum suction vehicles, waste suction vehicles, fecal suction vehicles, waste purification vehicles, sprinkler trucks, washing and sweeping vehicles, cleaning vehicles, road sweepers, and green spraying vehicles. According to the regulations, for specialized vehicles listed in the “List,” after its publication, applicants no longer need to repetitively apply for inclusion in the “Catalog” but can directly indicate the tax exemption status when uploading vehicle electronic information.

Taxpayers can apply for tax exemption from the competent tax authorities based on the vehicle’s electronic information, including the tax exemption indicator, and relevant documents.

The amount of vehicle purchase tax payable is calculated as: (Price on the invoice when registered) Price ÷ 1.13 × 10%. After tax exemption, customers can reduce the cost of purchasing vehicles and alleviate the burden on enterprises based on relevant policies.

How to handle tax exemption for specialized vehicles that were already sold before the publication of the “Catalog” Applicants can indicate the tax exemption status in the electronic information of the sold vehicles after their models are included in the “Catalog,” and then re-upload the information. Taxpayers can apply for tax exemption from the competent tax authorities based on the tax exemption indicator and other documents required for vehicle purchase tax declaration.

What should taxpayers do if specialized vehicles have already paid the vehicle purchase tax and are subsequently included in the “Catalog”? Applicants can indicate the tax exemption status in the electronic information of the sold vehicles after their models are included in the “Catalog,” and then re-upload the information. Taxpayers can apply for a tax refund from the competent tax authorities based on the tax exemption indicator and other documents required for vehicle purchase tax declaration, and the tax authorities will return the already paid tax to the taxpayers in accordance with the law.

Chengdu Yiwei New Energy Automobile Co., Ltd is a high-tech enterprise focusing on electric chassis development, vehicle control unit, electric motor, motor controller, battery pack, and intelligent network information technology of EV.

Contact us:

yanjing@1vtruck.com +(86)13921093681

duanqianyun@1vtruck.com +(86)13060058315

liyan@1vtruck.com +(86)18200390258

Post time: Feb-29-2024